Carbon pricing should be used to establish wealth funds from which current and future citizens can benefit.

The world has a limited carbon budget …

Climate change depends on the cumulative total of emissions of greenhouse gases, so total cumulative emissions globally must be limited by the need to limit climate change. This limited total of cumulative emissions is sometimes referred to as a global carbon budget. Specifically, if global mean surface temperature rises are to be limited to two degrees centigrade, as now mandated in the Paris Agreement, total cumulative CO2 emissions from now on must be limited to around 1600 billion tonnes of CO2[1]. From this perspective the atmosphere is a finite resource that can only be used once, rather like any exhaustible natural resource, with the important caveat that (unlike many natural resources) no more atmosphere remains to be discovered.

But currently the value of this resource is being squandered …

At the moment only a very small proportion of greenhouse gas emissions is priced adequately. Most emissions remain unpriced, and the growing proportion that is priced is mostly sold at well below both the cost of damages, and well below the value of an increasingly scarce resource. A valuable scarce resource is thus being given away or sold below cost, subsidising emitters. Huge natural wealth is being squandered. And once gone it can never be replaced[2].

It would be better to use revenue from carbon pricing to create a wealth fund to benefit both current and future generations …

So is there a better approach to managing this precious resource? It seems to me that there is. It would be much better to realise value of emissions in the form of a fund for citizens, with proceeds from carbon pricing (the sale of allowances or taxes) paid into the fund. Carbon pricing should be comprehensive, with prices at adequate levels. The finite volume of the resource implies it is best used to establish a wealth fund, where financial capital is built as natural capital is used up. The fund would belong to all citizens. Granting its value to citizens would surely encourage better management of the atmosphere, and thus the climate, and higher carbon prices than generally prevail at present.

Such a fund would be analogous to a sovereign wealth fund based on oil and gas reserves, of which the Norwegian fund is the leading example[3]. Wealth is invested in productive activity, with the income from this available to fund pensions and other expenditure. So, how much might this resource be worth in purely financial terms?

Such a fund could be enormously valuable …

Each tonne of CO2 emitted to the atmosphere should be priced at a minimum of the cost of damages from climate change – the social cost of carbon. This is currently around US$50/tonne, and rising over time. Emissions may be more valuable than this, either because of the limitations in estimates of the social cost of carbon (see here), or because the value of the emissions in terms of the economic activity they enable is greater than their cost in environmental damage. But evaluating the resource at its cost at least puts a lower bound on its value, unless the economic value of those emissions is below the cost assumed here, which seems unlikely with such a constraining budget[4].

The profile of emissions also matters. For simplicity I’ll assume current emission levels to 2020, then a linear decrease to the end of this century[5]. This is broadly similar to many emissions tracks that have been modelled as consistent with 2 degree warming, and (consistent with this) the cumulative total is close to the 1600 billion tonnes budget I mentioned above. It is also consistent with the Paris Agreement goals of reaching net zero emissions at some point in the second half of the century[6].

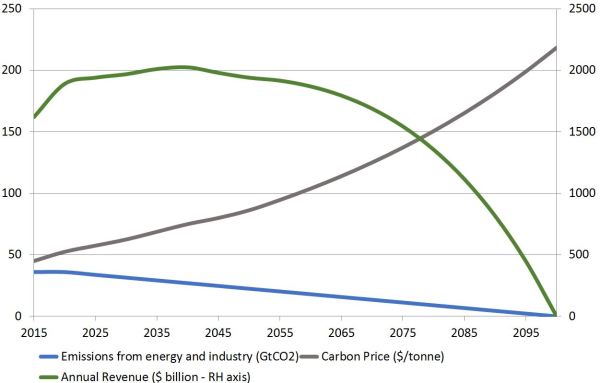

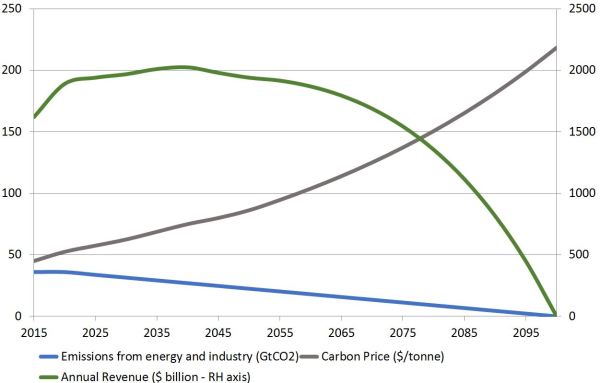

The annual value of emissions is then estimated from multiplying the (rising) cost of emissions with the (falling) quantity of emissions. This is shown in the chart below. The effects of rising prices and falling emissions roughly balance over the next 50-60 years or so, with revenues remaining roughly similar at close to $2 trillion p.a.. Revenues then fall rapidly in the last quarter of the century as emissions fall to zero. The eventual value of the fund, excluding investment returns and dividends paid out, is the sum of these annual revenues (the area under the curve).

Chart: Potential annual revenue into carbon funds globally …

On this basis, the total value of the remaining carbon budget is a staggering $130 trillion. This is equivalent to $13,000 for each person in the world, assuming world population of 10 billion people later this century. A 3% annual dividend from this would generate about $400 p.a. for everyone.

Towards a citizens’ dividend …

Dividends from the fund could be used in many ways. One approach with a range of advantages is distributing benefits to all in the form of a “citizen’s dividend”. There is already a feature of the Alaskan wealth fund derived from oil revenues, where distribution is in the form of a Permanent Fund Dividend to all citizens. This is widely considered to have helped build and maintain public support for the scheme[7].

This approach is closely related to the idea of “tax and dividend” carbon pricing. I have previously argued that such approaches have merit, and indeed tax and dividend has recently been advocated by senior Republicans in the USA[8]. However, there is an important difference between a fund and tax and dividend as often presented, in that revenues are used to establish a fund that is intended to be permanent, whereas tax and dividend proposals often assume revenues to be distributed in full.

There is also a relationship between the idea of a citizen’s dividend and a universal basic income, which is much discussed at the moment and subject to a few trials. However, there is a crucial difference in that the citizen’s dividend does not seek to provide an adequate income. Rather it is simply a return on funds invested. Instead, it is likely to be one component of any universal basic income.

Who would benefit?

There is a natural case for distributing dividends equally, as all have equal rights to the atmosphere. The atmosphere is a global resource, and climate change knows no borders, so it is natural to make any fund global. However establishing such an arrangement is likely to be too great a political challenge.

A bottom up approach with individual nations pricing carbon and establishing their own funds is likely to be much more tractable. Such a national approach would have other advantages. For example, it would allow other environmental taxes, such as those on landfill, and indeed other sources of revenue to contribute to the fund. A series of national funds would not stop any fund being used to finance activities of international benefit – indeed such uses would be highly desirable.

Establishing national funds will have many challenges. However the prize seems large enough to be worth pursuing. The current system of simply allowing emissions to be dumped into the atmosphere, often free of charge and almost always too cheaply, is a waste of a unique and irreplaceable asset. Irreplaceable natural wealth such as the atmosphere should be managed carefully, not squandered recklessly.

Adam Whitmore – 13th February 2017

[1] Based on “Warming caused by cumulative carbon emissions towards the trillionth tonne”. Allen et. al. Nature vol. 458 (2009), adjusted for emissions since the publication of that paper.

[2] Many people, including me, would also wish to note the ethical dimension here. It is not appropriate to treat the atmosphere only as mere resource for people to use as they wish, and all decisions about its management must reflect ethical considerations, including responsibilities to future generations, and the duty of care to the world’s natural heritage. I am simply arguing here that treating it as valuable resource would be a major step forward from treating it as a resource to be used as though it were unlimited and emissions were inconsequential, as is often the case at present.

[3] For an excellent review of Sovereign Wealth Funds and how they could be better managed and used for the benefit of citizens see Angela Cummine, Citizens’ Wealth, Yale University Press, 2016.

[4] If the price would be lower than the SCC with this emissions track it implies that the 2 degree target is too loose and 1.5 degree or lower would be preferred.

[5] This is a rough and ready calculation, taking CO2 emissions from energy and industry only. It ignores the effect of other gases and effectively assumes other sources of CO2, mainly deforestation, are approximately net zero cumulatively over the century after taking into account the role of sinks and deforestation. This may be optimistic. Adjusting for these would lead to a higher starting point and steeper decrease in emissions, reducing somewhat the value of the fund.

[6] In this scenario emissions are low enough to be balanced by a small quantity of negative emissions by the last decade of the century.

[7] See Angela Cummine, Citizens’ Wealth, Yale University Press, 2016., p.140-2.

[8] See “US Republican elders push for carbon tax”, Carbon Pulse, 8th February 2017