The UK carbon tax on fuel for power generation provides the most clear-cut example anywhere in the world of large scale emissions reductions from carbon pricing. These reductions have been achieved by a price that, while higher than in the EU ETS, remains moderate or low against a range of other markers, including other carbon taxes.

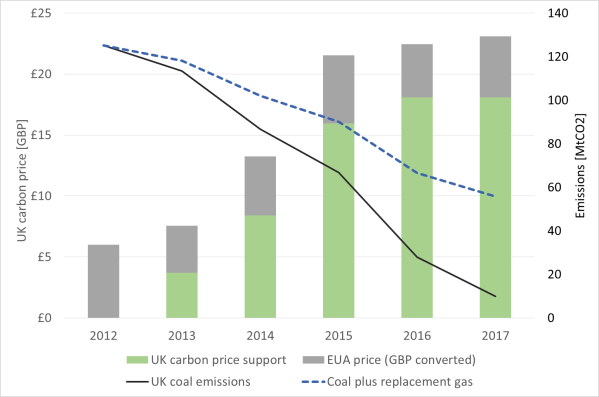

The carbon price for fuels used in power generation in the UK consists of two components. The first is the price of allowances (EUAs) under the EUETS. The second is the UK’s own carbon tax for the power sector, known as Carbon Price Support (CPS). The Chart below shows how the level CPS (green bars on the chart) increased over the period 2013 to 2017[i]. These increases led to a total price – CPS plus the price of EUAs under the EUETS (grey bars on the chart) – increasing, despite the price of EUAs remaining weak.

This increase in the carbon price has been accompanied by about a 90% reduction in emissions from coal generation, which fell by over 100 million tonnes over the period (black line on chart). Various factors contributed to this reduction in the use of coal in power generation, including the planned closure of some plant and the effect of regulation of other pollutants. Nevertheless the increase in the carbon price since 2014 has played a crucial role in stimulating this reduction in emissions by making coal generation more expensive than gas[ii]. According to a report by analysts Aurora, the increase in carbon price support accounted for three quarters of the total reduction in generation from coal achieved by 2016[iii].

The net fall in emissions over the period (shown as the dashed blue line on chart) was smaller, at around 70 million tonnes p.a. [iv] This is because generation from coal was largely displaced by generation from gas. The attribution of three quarters of this 70 million tonnes to carbon price support implies a little over 50 million tonnes p.a. of net emission reductions due to carbon price support. This is equivalent to a reduction of more than 10% of total UK greenhouse gas emissions. The financial value of the reduced environmental damage from avoiding these emissions was approximately £1.6 billion in 2016 and £1.8 billion in 2017[v].

Chart: Carbon Prices and Emissions in the UK power sector

The UK tax has thus proved highly effective in reducing emissions, producing a substantial environmental benefit[vi]. As such it has provided a useful illustration both of the value of a floor price and more broadly of the effectiveness of carbon pricing.

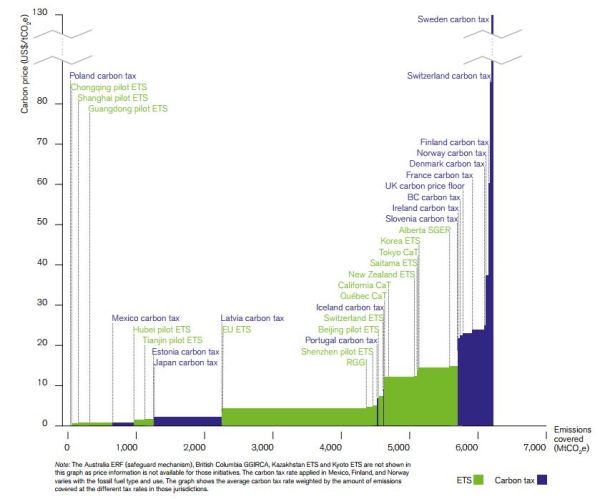

This has been achieved by a price that, while set at a more adequate level than in the EU ETS, remains moderate or low against a range of other markers, including other carbon taxes. CPS plus the EUA price was around €26/tCO2 in 2017 (US$30/tCO2). The French the carbon tax rose from €22/tCO2 to €31/tCO2 over 2016-2017. In Canada for provinces electing to adopt a fixed price the carbon price needs to reach CAN$50/tCO2 (€34/tCO2) by 2022[vii]. These levels remain below US EPA 2015 estimates of the Social Cost of Carbon of around €40/tCO2 [viii].

This type of low cost emissions reduction is exactly the sort of behaviour that a carbon price should be stimulating, but which is failing to happen as a result of the EU ETS because the EUA price is too low. More such successes are needed if temperature rises are to be limited to those set out in the Paris Agreement. This means more carbon pricing should follow the UK’s example of establishing an adequate floor price. This should include an EU wide auction reserve for the EUETS. The reserve price should be set at somewhere between €30 and €40/t, increasing over time. This would likely lead to substantial further emissions reductions across the EU.

Adam Whitmore – 17th January 2018

Notes:

[i] Emissions date for 2017 remains preliminary. UK carbon price support reached at £18/tCO2 (€20/tCO2) in the fiscal year 2015/6 and was retained at this level in 2016/7. In 2013/4 and 2014/5 levels were £4.94 and £9.55 respectively. This reflected defined escalation rates and lags in incorporating changes in EUA prices. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/293849/TIIN_6002_7047_carbon_price_floor_and_other_technical_amendments.pdf and www.parliament.uk/briefing-papers/sn05927.pdf

[ii] http://www.theenergycollective.com/onclimatechangepolicy/2392892/when-carbon-pricing-works-2

[iii] https://www.edie.net/news/6/Higher-carbon-price-needed-to-phase-out-UK-coal-generation-by-2025/

[iv] Based on UK coal generation estimated weighted average emissions intensity of 880gCO2/kWh, and 350gCO2/kWh for gas generation.

[v] 50 million tonnes p.a. at a social cost of carbon based on US EPA estimates of $47/tonne (€40/tonne).

[vi] There is a standard objection to a floor in one country under the EUETS is that it does not change of the overall cap at an EU level so, it is said, does not decrease emissions. However this does not hold under the present conditions of the EUETS, and is unlikely to do so in any case. A review of how emissions reductions from national measures, such as the UK carbon price floor, do in fact reduce total cumulative emissions over time is provided was provided in my recent post here.

[vii] The tax has now set at a fixed level of £18/tonne. It was previously set around two years in advance, targeting a total price comprising the tax plus the EUA price. There was no guarantee that it would set a true floor price, as EUA prices could and did change a good deal in the interim. Indeed, in 2013 support was set at £4.94/tCO2, reflecting previous expectations of higher EUA prices, leading to prices well below the original target for the year of £16/tCO2 in 2009 prices (around £17.70 in 2013 prices). See https://openknowledge.worldbank.org/handle/10986/28510?locale-attribute=en. The price is also below the levels expected to be needed to meet international goals (see section 1.2), and below the social cost of carbon as estimated by the US EPA (see https://onclimatechangepolicydotorg.wordpress.com/carbon-pricing/8-the-social-cost-of-carbon/ and references therein).

[viii] Based on 2015 estimates.